Countdown To QuickBooks Black Friday Sale Begins! Let’s Shop

Don’t miss out on the opportunity of grabbing the blockbuster deals and discounts on the upcoming ......

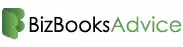

Best Ways to Fix QuickBooks Error 6000 (Company File Issue)

Are you stuck with the QuickBooks Error 6000 while opening the company file and failing to proceed w......

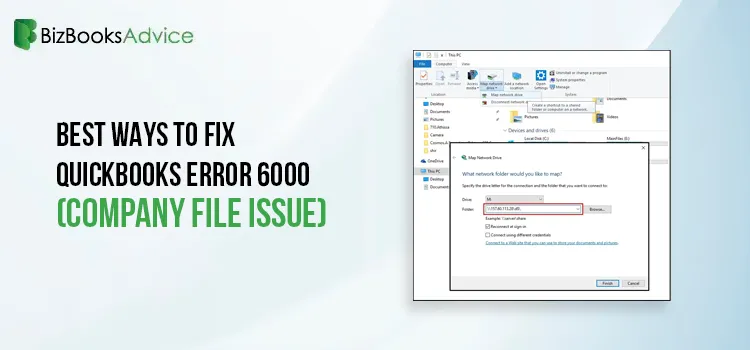

Fix QuickBooks Error 15203 With These Proven Methods

Are you stuck on QuickBooks Error 15203 while downloading the latest QuickBooks Desktop or payroll u......

QuickBooks Error 3000: Causes & How to Fix It

The users often come across QuickBooks Error 3000 while attempting to link their bank account with t......

Simple Methods to Resolve QuickBooks Error 6073 99001

At times, users might struggle with QuickBooks Error 6073 99001 while attempting to launch the data ......

Steps to Create and Send Purchase Orders in QuickBooks Online

Now, the businesses can easily create and send purchase orders in QuickBooks Online. The Purchase Or......

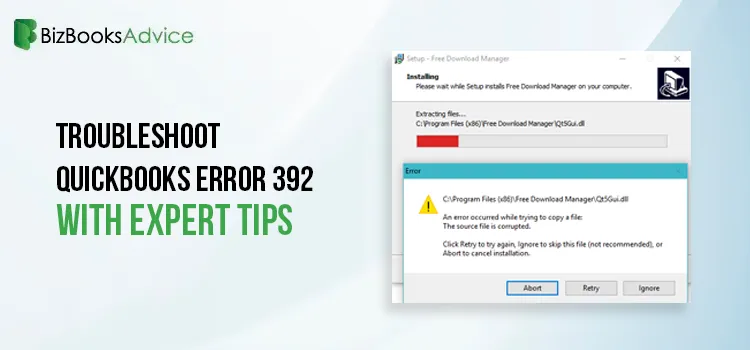

Troubleshoot QuickBooks Error 392 With Expert Tips

Most often, users get stuck with the QuickBooks Error 392 while installing, starting up, or closing ......

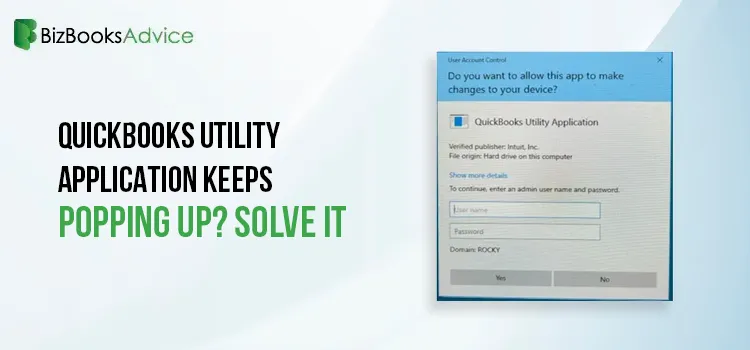

Fix QuickBooks Utility Application Popping Up Issue With Easy Tips

Is the QuickBooks Utility application popping up issue flashing on your computer screen while openin......

Learn How to Set Up & Use QuickBooks Inventory Tracking Software

QuickBooks Inventory Tracking is the best software that takes care of your inventory and makes it mu......